For some, the thought of turning 30 can be terrifying. Who wants to let go of the magic of their 20s, find their first silver strand or wake up to the sound of their biological clock ticking louder than ever… especially if they still haven’t figured their life out?

Thankfully, for most people who’ve already crossed over to their 30s, such fears were completely unfounded! Instead, they’ve embraced this coming-of-age and the many milestone moments they’ve encountered along the way. Besides, silver is a cool hair colour even among our favourite idols (BTS’s Jimin rocked it for the band’s Map of the Soul:7 album) and watching children grow is a joy like no other!

So, if you’re in your late 20s, get ready for an exciting ride. Here are the top six milestones to look forward to in your 30s…

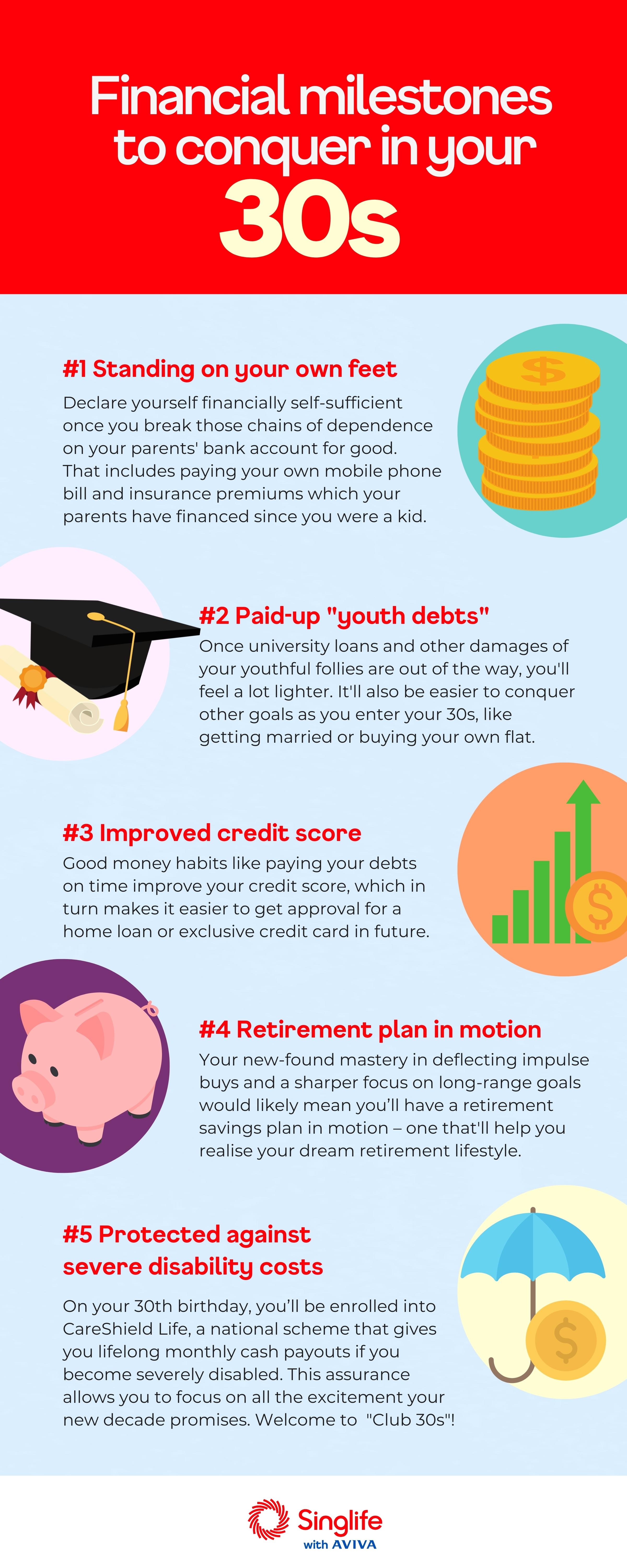

Milestone #1: Financial independence

You adore your parents for trying to support you even when you’re already earning your own keep. But is their gesture of love getting in the way of your financial independence? If you haven’t already weaned yourself off their bank account in your 20s, your 30s is a good time to do it. Now that you have a stable income, you can start to pay for your own meals, phone bills, and airfare when you take family trips. The next time your mum buys you underwear or your dad pays for fresh tyres while looking after your car, gently tell them that you love them, but you’ll manage on your own in future. Break those chains of dependence once and for all and declare yourself self-sufficient.

Milestone #2: Debt-free

This is one of the biggest milestones you’ll want to hit. Whether you’ve got S$8,000 or S$80,000 to clear on your student loan and credit card charges, set a goal to minimise and pay off those debts. Eliminating them can be as easy as simplifying your life: you could cut down on fancy meals, use public transport over cars and cabs to save more, or take up side gigs like giving tuition or pet-sitting for extra income. When you don’t have to carry loans and the damages of your youthful spending follies into your 30s, it’ll be easier to conquer other goals as you enter your 30s, like getting married or buying your own home.

Milestone #3: Improved credit score

Good financial habits like paying your student loan and credit card bills on time, and not taking on more financing than you need sets you up for an improved credit score. A credit score is like your financial health report card with details on your loans and credit card payment history as well as your credit card balance. Financial institutions scrutinise it when considering whether to grant your application for a S$500,000 home loan, for instance. Even if you’re not buying a home just yet, a high credit score could mean perks like access to the best reward credit cards, which in turn can reap huge cost savings. Credit reports are issued by a credit bureau to financial institutions when they make enquiries about you. You can also ask the bureaus for a copy of this.

These are the approved credit bureaus in Singapore:

For banks and financial firms

For licensed money lending

Milestone #4: Increasing net worth

Your net worth is the difference between the total value of your assets (home, car, retirement savings, investments, and so on) and the total value of your liabilities (car loan, mortgage, debts and so on). At some point in your 30s, this figure will go from a negative number to a positive one. And it’ll grow quickly as your salary increases during your early career years and the debts you took in your 20s are cleared. Take it a step further and aim to increase your net worth by 30% of your annual income each year, for instance. One way to do this is by making extra loan repayments each month rather than just paying the minimum amount, but do check your loan terms first to ensure you won’t face prepayment penalties.

Milestone #5: A sound retirement plan

Your new-found mastery in deflecting impulse buys and a sharper focus on long-range goals would likely mean you’ll have a solid retirement savings plan in motion – one that’ll help big-dreaming millennials like you realise your aspirations for the future. The plan might include supplementing the savings in your CPF Special Account with a portfolio of investments, a side income from delivering parcels in your free time, and/or a retirement savings policy you bought through an insurer. The bonus that comes with this assurance of knowing you can retire comfortably: better sleep at nights (which means fewer wrinkles!).

Milestone #6: Coverage under the national long-term care protection scheme

This is like your big, official welcome into “Club 30s”. As soon as you hit your 30th birthday, you’ll be enrolled into CareShield Life, a national long-term care scheme that provides monthly cash payouts for disability starting at S$600 in 2020. The severe disability payouts are for life, as long you’re unable to perform at least three out of the six Activities of Daily Living (Walking or Moving Around, Dressing, Washing, Feeding, Transferring, Toileting). You might be thinking that only older folks need long-term care. However, the fact is that even 30-year-olds can become disabled due to an accident or severe illness, making disability payouts crucial for helping to cover everything from therapy to daily living expenses. For higher disability payouts, you can enhance your CareShield Life plan with a CareShield Life supplement from private insurers, such as Singlife.

With these 30s milestones conquered, you’ll feel more like you’ve really become an “adult”, and it’ll show as you take on life with greater confidence.

Terms and conditions apply.

These policies are underwritten by Singapore Life Ltd.

This material is published for general information only and does not have regard to the specific investment objectives, financial situation and particular needs of any specific person. You should read the Product Summary and seek advice from a financial adviser representative before making a commitment to purchase the product.

As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premium paid. Buying a health insurance policy that is not suitable for you may impact your ability to finance your future healthcare needs. Investments in this plan are subject to investment risks including the possible loss of the principal amount invested. The value of the units, and the income accruing to the units, may rise or fall. Past performance of the ILP sub-fund(s) is not necessarily indicative of future performance.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Protected up to specified limits by SDIC.

Information is accurate as at 13 October 2022.